501(c) Ownership Type - Not For Profit

If your organization is classified as a 501(c) Not For Profit, please follow the instructions below to ensure your tax-exempt status is verified.

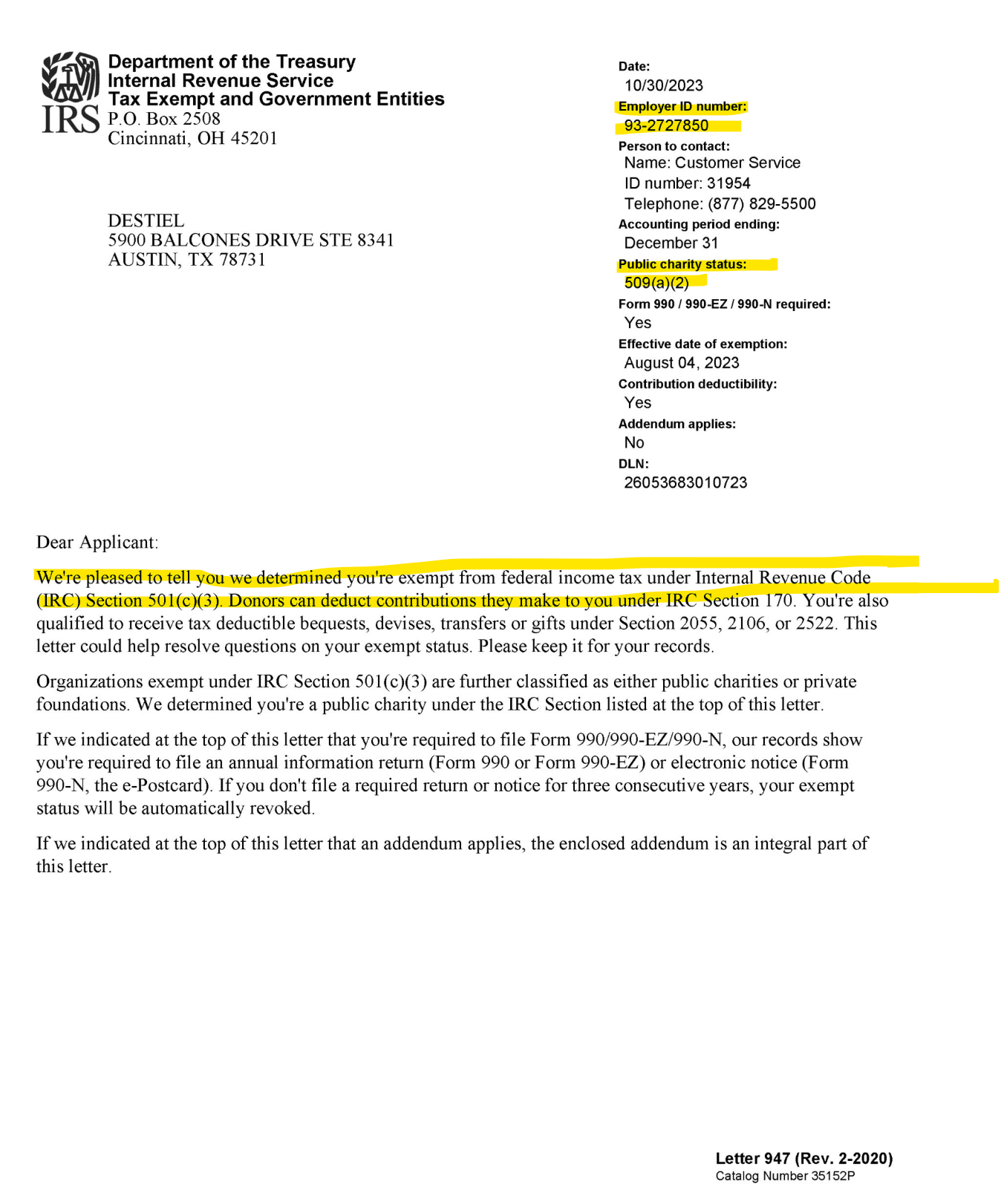

Below is a sample 501(c) determination letter that is required to be sent to the underwriters for verification of 501(c) ownership.

Please provide the first page of your IRS determination letter. This page must clearly identify your EIN (Employer Identification Number) and the approved Tax-Exempt Status designation (e.g., 501(c)(3), 501(c)(4), etc.).

📤 Submission Instructions

- Upload the first page of your IRS 501(c) determination letter.

- Email the document to: risk@tripleplaypay.com

📨 Email Requirements

-

Subject Line: Include your Legal Business Name

Example:501(c) Letter – Springfield Nonprofit Organization -

Body of the Email: Include your EIN number for reference.